E-Invoicing

A national digitalisation agenda to improve business efficiency and productivity.

The National E-Invoicing Initiative aims to drive interoperable E-Invoicing by digitalising how businesses send invoices to other businesses.

OBJECTIVE

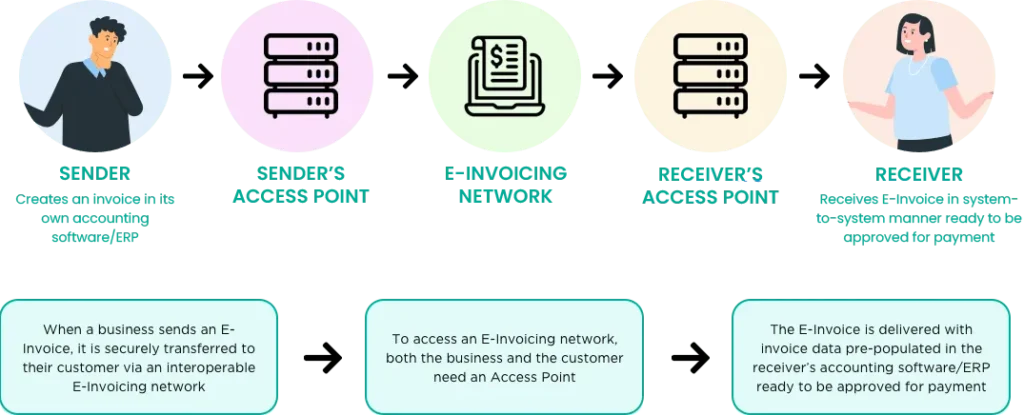

The National E-Invoicing Initiative aims to drive interoperable E-Invoicing by digitalising how businesses send invoices to other businesses, allowing different accounting software and Enterprise Resource Planning (ERP) system to send and receive e-invoices in a system-to-system manner.

THE BENEFITS

INCREASE BUSINESS EFFICIENCY

E-Invoicing eliminates manual data entry and paper handling, enabling businesses to transact invoices more efficiently and seamlessly, with accurate traceability.

IMPROVE CASHFLOW

With E-Invoicing, billing and calculation errors can be reduced significantly, thus accelerate payments and minimise disputes in irregularities.

EFFICIENT TAX COMPLIANCE

The implementation of a compliant interoperable E-Invoicing framework will ensure an organised work process and facilitate effective tax reporting.

JSoft Solution Sdn Bhd as Malaysia's Peppol Authority

As a Peppol Authority, JSoft Solution Sdn Bhd plays the role of accrediting Malaysia's Peppol service providers and Peppol ready solution providers, specifying local requirements and technical standards, governing the overall Peppol framework compliance and promote the business adoption of E-Invoicing in Malaysia.

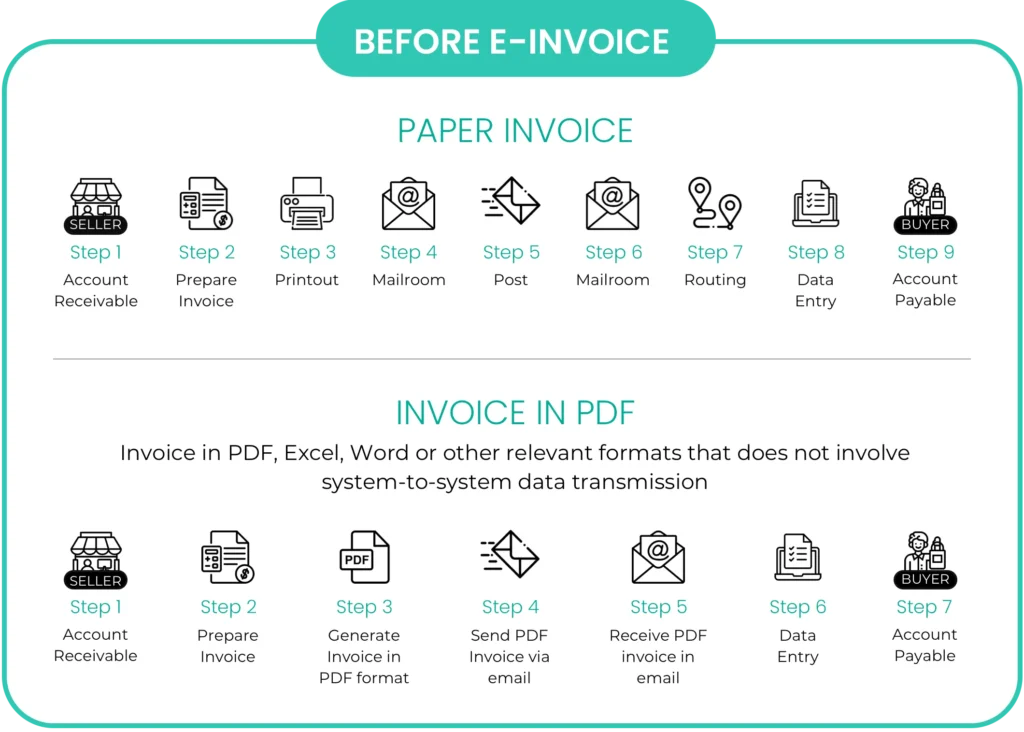

Different Manner in Sending and

Receiving Invoices

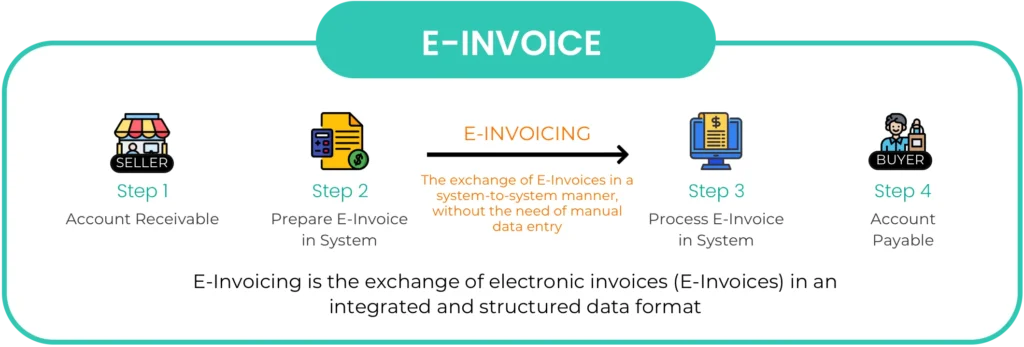

How E-Invoicing Works

MORE INFORMATION

Peppol Service Providers (SP)

Peppol Service Providers (or Access Point (AP) Providers) are responsible for creating and maintaining the gateways that connect businesses and software to the e-Invoicing network. Learn about the requirements to become a Peppol SP in Malaysia.

Peppol-Ready Solution Providers (PRSP)

Peppol-Ready Solution Providers are accounting software, ERP or solutions that provide the functionality of sending and receiving e-Invoice without necessarily becoming an Access Point (AP). Learn about the requirements to become a PRSP in Malaysia.

Malaysia PINT Specifications

Peppol International Invoice (PINT) is the specification that facilitates interoperable exchange of invoices across the Peppol Network at a global level. Learn more information on Malaysia PINT specifications.

FREQUENTLY ASKED QUESTIONS

JSoft Solution Sdn Bhd plans to have an interoperable E-Invoicing framework in place by early 2024. Technical guidelines suited to local requirements target to be ready by end of 2023 and will be published on JSoft Solution Sdn Bhd website.

This initiative aims to introduce an interoperable E-Invoicing framework that will standardise the specifications and message formats for the transmission of electronic invoices between various accounting software/ERP systems. This will enable the sending of e-invoices without the need for direct integration, irrespective of the software/hardware used, similar to how credit cards or telco networks operate.

The Peppol E-Invoicing framework is considered to be the most suitable for implementation in Malaysia due to its maturity, interoperability, and well-governed standards. It is also the most widely used E-Invoicing framework globally, adopted by more than 20 countries (refer to country list

Peppol consists of technical specifications that can be implemented in any existing eProcurement solutions or Enterprise Resources Planning (ERP) systems to make them interoperable between disparate systems across countries.

Peppol is not a portal or a provider of exchange services; it is an enabler. Any organisation can send and receive business documents across the Peppol Network via their chosen Peppol-accredited Service Provider.

The function of a Peppol Authority is to manage the implementation of the Peppol framework in a particular country. This includes localising the Peppol standards to suit local requirements and to accrediting service providers that adhere to the Peppol standards. JSoft Solution Sdn Bhd functions as the Peppol Authority for Malaysia.

JSoft Solution Sdn Bhd is undertaking the implementation of interoperable e-invoicing for business digitalisation, aiming to facilitate the seamless exchange of e-invoices among businesses (B2B). This is achieved through the implementation of Peppol e-Invoicing framework, for which JSoft Solution Sdn Bhd functions as the Peppol Authority for Malaysia. LHDNM is responsible for e-invoicing for tax reporting and compliance. JSoft Solution Sdn Bhd and LHDNM are working together to implement e-Invoicing in Malaysia.

According to LHDNM’s website, businesses with an annual turnover of RM100 million and above will be mandated to implement e-Invoice for tax compliance on 1st August 2024. The implementation of e-Invoice will be mandatory for all businesses on 1st July 2025. For the latest information on e-Invoicing for tax reporting and compliance, please

You should not be required to replace your current systems. This initiative aims to standardise the specification and message format used for the transmission/exchange of e-invoices between different accounting software/ERP systems. The standardisation of the e-Invoice format is technically configured in your accounting software by your service provider. Consult your accounting service provider to determine whether they can/will support the Peppol framework. If you would like to know more details, you may reach out to us

Why choose us?

A descriptive paragraph that tells clients how good you are and proves that you are the best choice that they’ve made.